- #Word bookkeeping template how to

- #Word bookkeeping template software

- #Word bookkeeping template free

Readers should verify statements before relying on them.

#Word bookkeeping template free

does not warrant that the material contained herein will continue to be accurate nor that it is completely free of errors when published. Accordingly, the information provided should not be relied upon as a substitute for independent research. does not have any responsibility for updating or revising any information presented herein.

No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation. Applicable laws may vary by state or locality. Additional information and exceptions may apply. This content is for information purposes only and should not be considered legal, accounting, or tax advice, or a substitute for obtaining such advice specific to your business. And a large number of data entries may increase the risk of error. Unfortunately, creating a general ledger using Excel is time-consuming.

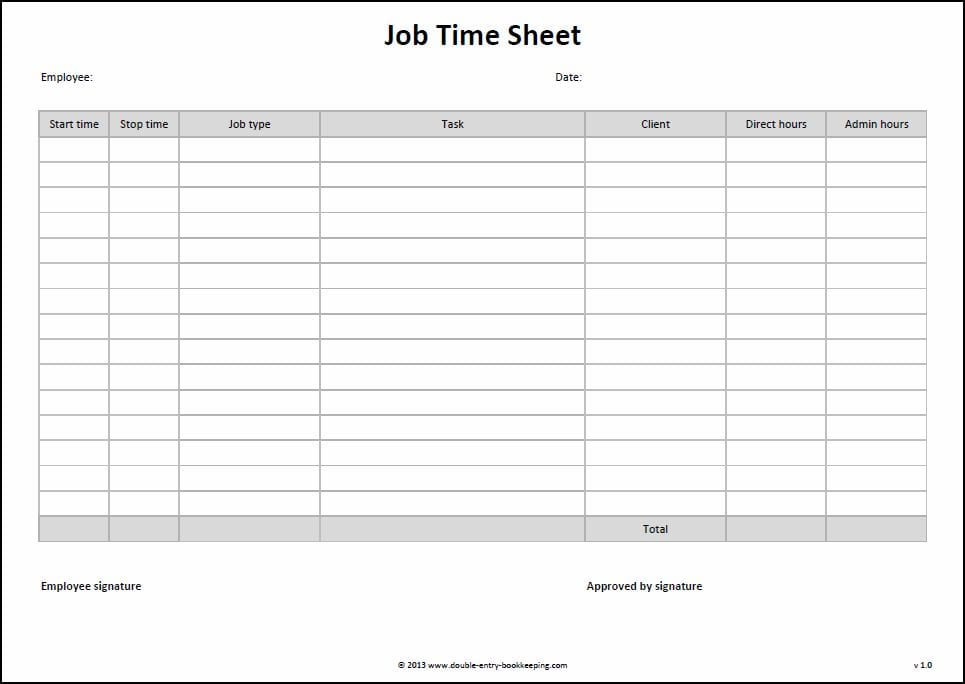

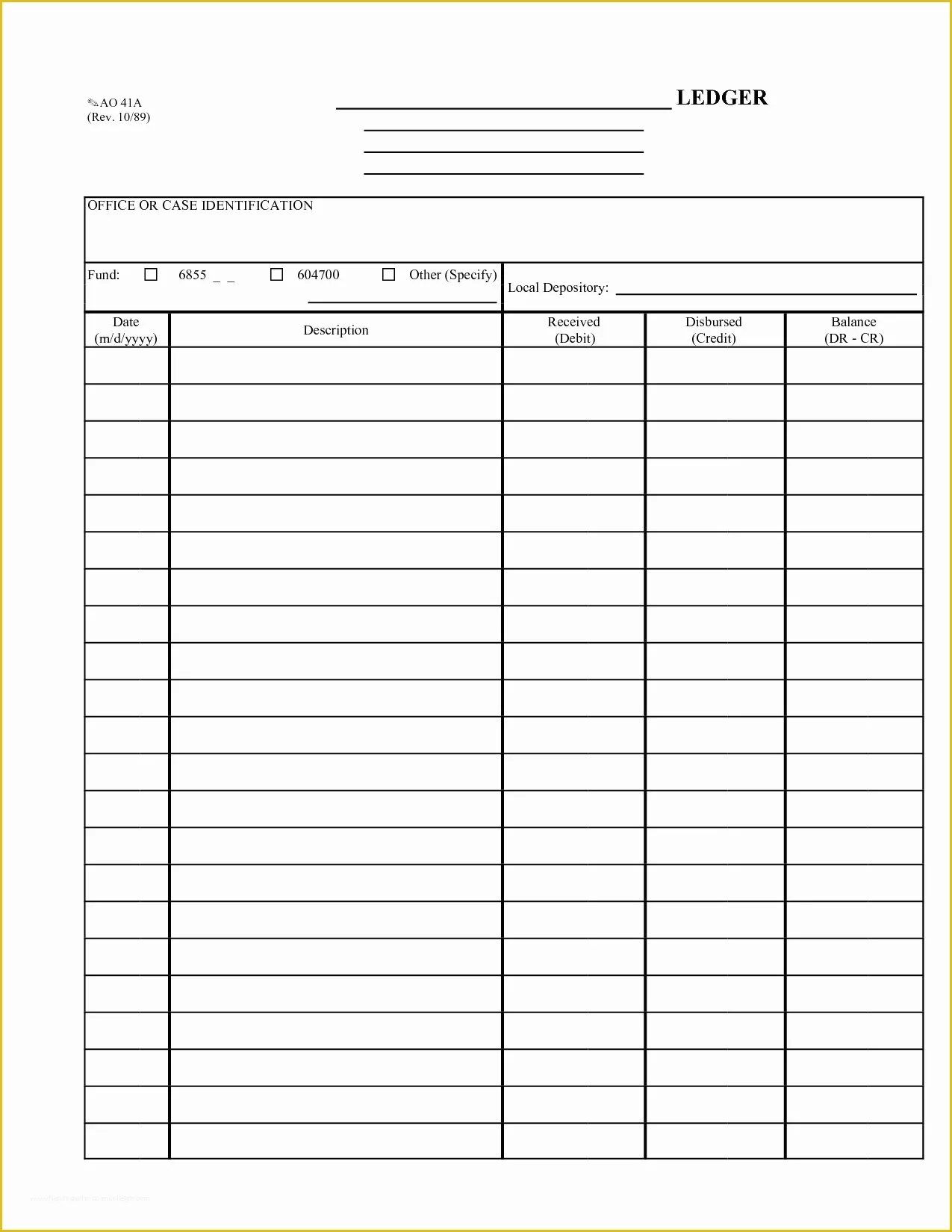

The benefit of the general ledger is that you can review every journal entry that impacted a particular account. The inventory increase (debit) is listed in the inventory general ledger but not in the cash general ledger. 1 only lists the $10,000 reduction (credit) in cash. It’s important to note the cash general ledger page only lists the cash portion of each journal entry. General ledgers provide the date, journal entry, and the entry description, along with the debit or credit amount and the ending balance. Each account lists the journal entries that posted activity to the account during a particular month. General ledgers sort transactions by account. Business owners and accounting professionals use the data in the general ledger to create financial statements.

#Word bookkeeping template how to

How to use the general ledger to create financial statementsĪ company’s general ledger is a record of every transaction it posts throughout its lifetime, including all journal entries.

#Word bookkeeping template software

$10,000 assets increase = $10,000 increase liabilities + $0 change equityĪccounting software ensures that each journal entry balances the formula and total debits and credits. On your balance sheet, you’d add the $10,000 increase in liabilities to the $0 change in equity to get a $10,000 assets increase. The company posts a $10,000 debit to cash (an asset account) and a $10,000 credit to bonds payable (a liability account). But assets must stay balanced with liabilities and equity.Īssume, for example, that a business issues a $10,000 bond and receives cash. You can use the formula to create financial statements. Add liabilities to equity to determine your assets. You can think of equity as the true value of your business.Ī balance sheet formula connects the balance sheet components. Equity is the difference between assets and liabilities.Liabilities include accounts payable and long-term debt. Liabilities are what your business owes to other parties.Assets are the resources you use to produce revenue. Business owners also review income statements and cash flow statements.Ī balance sheet reports your business’s assets, liabilities, and equity as of a specific date. The balance sheet is one of the three basic financial statements that every business owner should analyze to make financial decisions. The balance sheet formula (or accounting equation) determines whether you use a debit or a credit for a particular account. Using the balance sheet formula to post journal entries The first thing they’ll need to do is create a chart of accounts. They’re using an Excel bookkeeping template to manage the business. Let’s look at an example.Ĭenterfield Sporting Goods opened on January 1, 2020. You’ll need to set up accounts, post transactions, and create financial statements using Excel. In the meantime, you’ll still need to understand the accounting process and how you can complete each task using Excel accounting. And bookkeeping in Excel can lead to errors and inefficiency.

As your business grows, you’ll need to post more accounting transactions. But keep in mind that Excel bookkeeping is not a solution for a growing business. Most people are familiar with Excel, and using the application is straightforward. Many small business owners use an Excel accounting template when they start operations. So you may not have automated administrative tasks like bookkeeping and accounting when you open your doors. Your top priorities may be to find customers and deliver a great product or service. When you start your business, time and money may be in short supply.

0 kommentar(er)

0 kommentar(er)